Planned Giving

Healthcare with Heart

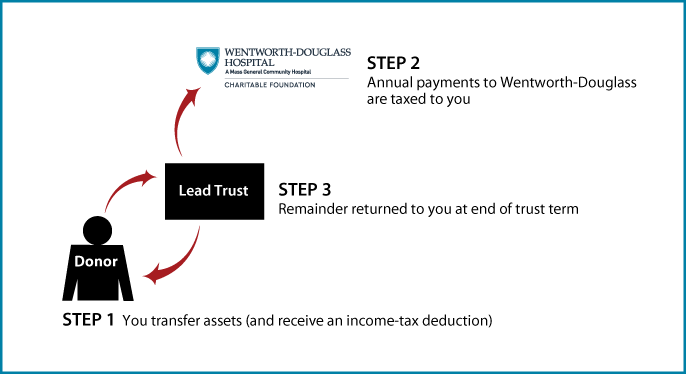

Grantor Lead Trust

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years), transfer cash or other property to trustee, and receive an income-tax deduction

- Trustee invests and manages trust assets and makes annual payments to Wentworth-Douglass

- Remainder transferred back to you

Benefits

- Annual gift to Wentworth-Douglass

- Property returned to donor at end of trust term

- Professional management of assets during term of trust

- Charitable income-tax deduction, but you are taxed on trust's annual income

More Information

Request an eBrochure

Request Calculation

Contact Us

Maryellen Burke |

Wentworth-Douglass Foundation Federal Tax ID Number: |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

Contact Us

For more information about gift planning, contact Maryellen Burke, Chief Development Officer, at 603-609-6207 or Mburke33@mgb.org.

Wentworth-Douglass Hospital & Health Foundation is a 501(c)(3) charitable organization. Gifts are tax deductible to the full extent of the law.

EIN: 51-0491062